Despite the current economic turmoil, many people are warning that the technology market is falling foul of another bubble. I've been following the discussion with fascination, and last week this article from TNW debunking the theory really caught my eye. This is not another technology bubble, this is natural economic growth resulting from the real world adoption of new technologies that is (finally) starting to occur.

As e-commerce took off in the mid-to-late 90s the tech industry got a glimpse of the future: everyone and everything would be online, all the time. Suddenly the potential value of Internet real estate became clear and investors all happily jumped on the bandwagon. What no-one seemed to grasp at that time (and still don't) is that the rush of early adopters was not an indicator of how quickly new online technology was going to be adopted by the mainstream (where the real money is).

A classic case of supply and demand going horribly wrong.

Companies and VCs everywhere were investing unbelievable figures to get ready to supply what they expected would be enormous demand for their services, but the huge rush of demand never came. Even today, 10 years later, there are only a few online services which really, truly permeate the average day of an average person, Facebook being the prime example. Twitter, the service that I love and use the most, is something that the majority of people have heard of, and maybe even have an account on, but they aren't using it yet.The average person is only just starting to use Facebook (sometimes), shop online (mostly at Christmas), and use Google to find stuff out (when they remember Google exists). However, as some parts of the Internet are finally starting to saturate the mainstream of the market, we are beginning to get real world data indicating the true value of potential revenue streams that can be derived online. This means that investors can part with their money with confidence again.

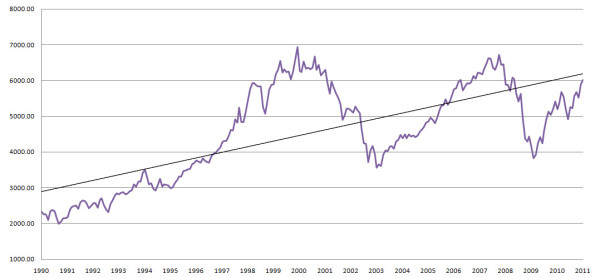

20 years of the FTSE100

[caption id="attachment_2115" align="aligncenter" width="600" caption="FTSE100 Month Close Figures 1990-2011"] [/caption]

[/caption]

The last 20 years of the FTSE100 tell an interesting tale. Whilst the markets are climbing back rapidly from the impending-recession related crash in 2009, there's no sign that the markets are significantly strong at the moment. It appears that we're just about where we should be.

Someone somewhere is always predicting the next big thing, or conducting a PR campaign about how the Internet/e-commerce/the mobile web has finally arrived. I'm not saying the Internet has finally arrived, or that this is the year the mobile web goes truly mainstream, or anything like that. Slowly but surely Internet usage is increasing as well as adoption, and the average user is more than just connected, they're becoming involved. As this continues I believe we will see increased confidence in the markets, massive valuations and buy-outs of tech companies will continue, and perhaps finally, 10 years on, this is sustainable.

Maybe if things had been different, we would have seen steady (but increasing) growth starting in the mid 90s and still ongoing today. Instead everyone jumped aboard a little too quickly and the whole thing went under. That's why I don't believe the current markets and valuations indicate another bubble... I think we're just getting back on course.